Photo by Exodus

Photo by Exodus

Introduction

In this report, we will examine LooksRare from a variety of aspects (what it does, how it works, a competitor analysis, problems and potentials of such NFT marketplaces) to see what we can learn from LooksRare. The target audience of this report is people with technical backgrounds who are interested in learning more about the current state of the Web3 and NFT industries from both technical and business perspectives.

Background

Before we dive into NFT marketplaces like LooksRare, let me briefly introduce NFT and NFT marketplaces.

NFT (Non-Fungible Token): What is it? To answer this question, we should learn about Fungible Tokens to understand its antonym. According to Larousse, "things that are consumed by usage and can be replaced by things of the same kind, the same quality and the same quantity" are considered fungible. For example, in the blockchain ecosystem, Sandbox's $SAND tokens are fungible and will always have the same value if they are swapped with one other. They can be used to buy LANDs in the Sandbox, which are nonfungible.

An NFT (Non-Fungible Token) is a piece of data that is stored on a blockchain that guarantees a cryptographic asset is unique and hence not interchangeable while also providing a unique digital certificate of ownership for the NFT. In a broader sense, an NFT records the "provenance" of the assigned digital object, providing unquestionable answers to issues like who produced, possessed, and owned the NFT in the past, as well as which of the numerous copies is the original. Photos, films, and audio can all be associated with an NFT as digital objects of various forms. In a variety of contexts, including gaming, art, and sports collectibles, NFTs are currently being utilized to commercialize digital artifacts. NFTs were initially a component of the Ethereum blockchain, but more and more blockchains are now adopting their own versions of NFTs.

NFT Marketplace: As implied by the name, it is a platform where NFTs can be shown, traded, and in some cases created (minted). Similarly to how Amazon or eBay are to products, these marketplaces are to NFTs. Although there are different types of NFT marketplaces for different forms of NFT, we will focus on universal NFT marketplaces (i.e., marketplaces that have any sort of NFT collection) like LooksRare and OpenSea in this report. If you are interested in learning more about NFT and NFT marketplaces, read this and this.

What is LooksRare

LooksRare is a NFT marketplace with a focus on the community, describing itself as a platform “by NFT people, for NFT people”. LooksRare has drawn a lot of interest in the NFT market since its launch on January 11th of this year, primarily because, unlike VC-backed OpenSea, it genuinely conforms to the Web3 principles by rewarding users for their participation and staking its own token $LOOKS. It gained notice right away in terms of both trading volumes (wash trading was making a lot of noise) and protocol profitability.

LooksRare aims to actively reward those who trade, collect, and create. Rewards come in a variety of forms:

- LOOKS Staking to Earn Platform Fees: LOOKS token stakers earn 100% of the trading fees (in WETH) on LooksRare.

- Listing Rewards: LooksRare's Listing Rewards program enables NFT collectors and traders to earn LOOKS tokens just by listing NFTs for sale on LooksRare.

- Trading Rewards: Trade any NFT on LooksRare, Earn LOOKS tokens.

- LOOKS Staking Rewards: When you stake LOOKS, you also earn additional LOOKS on top of the trading fee rewards received in WETH.

- Liquidity Provider Rewards (Discontinued since 2022/02/15, 10:15 AM (UTC)): LooksRare is incentivizing liquidity for the LOOKS token by giving rewards for users that stake LOOKS-ETH UniV2 LP tokens. The announcement for the discontinuation is here.

As a part of LooksRare's initial launch, there was an airdrop of LOOKS tokens as well. Users who have transacted > 3ETH worth of NFTs on OpenSea between 16 June and 16 December 2021 are the target users for the airdrop. You may find information on token allocation here. By providing incentives to this group of valuable users, the trading volume rises as a result of their natural inclination to list and trade NFTs on LooksRare. The term "Vampire Attack" refers to such go-to-market strategy of drawing users away from an established platform and toward a competing one by providing an incentive (usually tokens).

The section below titled "How LooksRare Works" will provide a thorough analysis of rewards and airdrop.

As seen in the graph, the rewards and incentives outlined above initially successfully increased trading on LooksRare.

(Graph: LooksRare Volume without wash trades filtered)

However, through wash trading, speculators found opportunities to reap the rewards. In this case, it means that the same individual trades NFTs using his/her own different wallets in order to benefit from trading rewards. The following graph demonstrates how significantly less trading volume when wash trading is filtered. Here, Web3 data scientist Hildobby explains how this filter was used and why the figures are startlingly different.

(Graph: LooksRare Volume with wash trades filtered)

However, I agree with the argument that if used temporarily, such a technique may vampire a network and drain off some of the OpenSea volume, which every day generates millions of dollars in fees. LooksRare views wash trading as dangerous for the traders because they are unsure of how much other traders will contribute to the total trading volume. LooksRare responsed to wash trading in their official docs.

Let's have a quick review at the team and what they get from this project.

- The platform was created by a team of 28 people (14 previously) under the anonymous Guts and Zodd. The co-founders are "NFT nerds" who have long been active in the NFT field using various aliases, according to the interview with The Block. They were frustrated with the current NFT marketplaces and decided to start LooksRare because they could not fork OpenSea to get what they needed. The team said that by structuring the smart contracts for the marketplace in a modular manner, they would be able to make modifications quickly. They also intend to support L2 networks, which would enable less expensive and quicker transactions. The team is active, polishes the user experience a lot, makes consistent progress, and is actively recruiting for various positions.

- Since the team also holds the token, they have an incentive to continue developing the platform and enhancing the product because the token's value is based on the amount of transactions and platform fees. The vesting schedule also demonstrates the team's dedication. The team won't start earning LOOKS tokens for another six months. This suggests that, as opposed to a pump-and-dump project, the team truly intends to construct the platform. The token emission schedule and token allocation will be analyzed in "How LooksRare Works" section as well.

- As the Docs, website, and Discord initially only supported English and Chinese, we might surmise that there are Chinese members who directly participated in this project even though the team remains anonymous.

How LooksRare Works

The most crucial component of LooksRare's system, the LOOKS token, which distinguishes it from OpenSea, can be learned first in order to comprehend how it works.

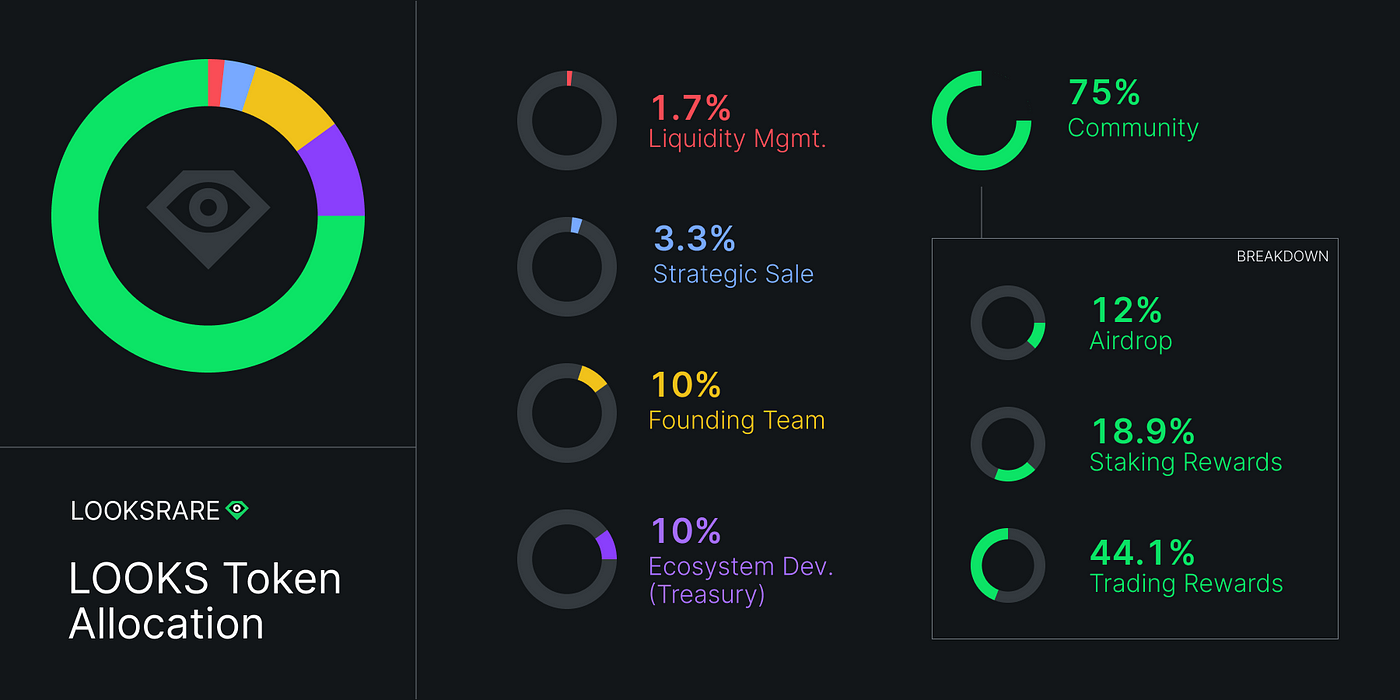

(Image: LOOKS Token Allocation)

| Percentage of supply | Total LOOKS | |

|---|---|---|

| Airdrop | 12% | 120,000,000 |

| Strategic Sale | 3.3% | 33,083,003 |

| Liquidity Management | 1.7% | 16,916,997 |

| Volume Rewards | 44.1% | 441,000,000 |

| Staking Rewards | 18.9% | 189,000,000 |

| Founding Team | 10% | 100,000,000 |

| Treasury | 10% | 100,000,000 |

| Total Supply | 100% | 1,000,000,000 |

The table above illustrates how tokens are distributed across the team, investors, protocol, and community. Let's focus on the community tokens:

Airdrop: 12% (120M) of the token is used in Airdrop.

(Graph: Number of claimed LOOKS token airdrop)

(Graph: Number of claimed eligible addresses)

As of this writing, 81.97% (98,366,481/120,000,000) of the LOOKS airdrop has been claimed by 67.31% (124,665/185,223) of the eligible addresses. For more stats for the Airdrop, have a look at this stats. Airdropping this group of valuable users encourages them to list and trade NFTs on LooksRare, which can increase trading volume in the market, as we previously indicated.

Staking rewards: 18.9% (189M) of the tokens are distributed as staking rewards.

Along with the trading fee you might receive when you stake LOOKs, the project might give you an additional staking rewards distribution in the short run. This gives people an additional incentive to stake LOOKS at the project's early stages. This is also the reason why a staking reward increase to 1000% is possible.

Actually, about half of the staking reward comes from the staking rewards (LOOKS), with the remaining half comes from the trading fees (WETH). Since the stakers split the benefits proportionally, the APR return eventually declines as the number of users rises.

In addition to the trading fee rewards earned in WETH, you also gain additional LOOKS when you stake LOOKS. Users who want to just leave their LOOKS tokens staked will have their staked LOOKS tokens automatically compounded.

The calculation of staking rewards has a fairly simple formula (Actually, LooksRare's math has always been straightforward. We will discuss its pros and cons later):

The formula used to determine User A's LOOKS staking rewards per block is: LOOKS per block * (LOOKS staked by User A / Total amount of staked LOOKS)

Example

- User A stakes 10,000 LOOKS during Phase A

- The total amount of staked LOOKS is now 1,000,000 LOOKS

Based on the above, User A would receive: 189 * (10,000 / 1,000,000) = 1.89 LOOKS per block

| PHASE | Length | LOOKS Per Block | LOOKS Per Day |

|---|---|---|---|

| A | 195,000 blocks (30 days) | 189.00 LOOKS | 1,228,500.00 |

| B | 585,000 blocks (90 days) | 89.775 LOOKS | 583,537.50 |

| C | 1,560,000 blocks (240 days) | 35.4375 LOOKS | 230,343.75 |

| D | 2,346,250 blocks (361 days) | 18.90 LOOKS | 122,850.00 |

Based on a schedule of 6,500 Ethereum blocks per day, LOOKS staking rewards will be paid during 4 phases at varying reward rates.

Trading rewards: 44.1% (441M) of the tokens are distributed as trading rewards.

The token economy of LooksRare, which aims to become the most liquid NFT market in the world, is fundamentally based on trading rewards. Trading rewards in the form of LOOKS, LooksRare's platform token, are given to users who trade any NFTs on the exchange. For their trade volume, both the buyer and the seller of an item receive rewards (except for private sales). Users receive trading rewards two hours after the end of each day after they are calculated daily.

Similarly, early adopters who trade NFTs through LooksRare receive additional trading benefits. The distribution runs out in 721 days according to the timeline below.

| PHASE | Length | LOOKS Per Day For Trading Rewards |

|---|---|---|

| A | 195,000 blocks (30 days) | 2,866,500.00 |

| B | 585,000 blocks (90 days) | 1,361,587.50 |

| C | 1,560,000 blocks (240 days) | 537,468.75 |

| D | 2,346,250 blocks (361 days) | 286,650.00 |

Each day, trade awards are computed based on each user's LooksRare trading volume as a proportion of all daily trading volume on the site, excluding private sales.

User A's trading rewards on Day 1 is: $$c * (a / b)$$

Where:

- a = User A's Trading Volume During Day 1

- b = Total Platform Trading Volume During Day 1

- c = LOOKS Rewards Per Day

Example

- User A trades 10 ETH worth of NFTs on Day 1

- There is 10,000 ETH total volume on LooksRare on Day 1

Based on the above, on Day 1, User A would receive: 2,866,500 * (10 / 10,000) = 2,866.5 LOOKS

Platform Fees:

LooksRare charges a baseline 2% (in WETH) sales fee on all NFT transactions aside from private sales. At the conclusion of each recurrent 6,500 Ethereum block period (approximately 24 hours), all WETH earned from these fees is consolidated and distributed to LOOKS stakeholders in a linear format per block during the following 6,500 block period.

Active and Passive Staking:

At the conclusion of the preceding period, incentives are calculated for each day and divided between active and passive stakeholder groups before being given out. Passive staking does not result in more Looks being earned when staked, which is the fundamental distinction between active and passive stakers. The bulk of stakers, whose staked LOOKS tokens are fully unlocked, are active stakers. The term "passive stakers" refers to holders of Team, Treasury, and Strategic sale tokens, which are locked for trade but unlocked for staking (which unlock over time - learn more).

A part of the WETH fees earned during the previous 6,500 blocks is sent to the Passive Staking address at the beginning of each 6,500 block period. The amount is determined as follows: $$c * (a / b)$$

Where:

- a = Total amount of LOOKS staked passively at start of period

- b = Total amount of LOOKS staked at start of period (passive + active)

- c = Amount of WETH fees from previous 6,500 blocks

The remaining WETH is then sent to the Active Staking Pool.

How is WETH fee sharing calculated for Active LOOKS stakers?

The amount of WETH rewards to be awarded to active stakers in each block for each 6,500-block period is determined as follows: Total WETH collected as fees in the prior 6500 block period / 6500.

Each user's amount of staked LOOKS at each block is then compared against the total amount of LOOKS staked at each block, with this being done at every block within the 6,500 block period to find the total amount of WETH rewards received.

Example

- Let's assume LooksRare processes 10,000 WETH of non-private sale volume in the first 6,500 blocks after launch, collecting total fees of 200 WETH.

- At block #6500, User A stakes 10,000 LOOKS in preparation to start earning WETH at block #6501.

- At block #6501,

- The amount of passive tokens staked is 10% of the total amount of tokens staked, meaning 20 WETH

(10% * 200)is sent to the passive staking address. - The remaining 180 WETH is put into the active LOOKS staking pool, with 0.027692 WETH to be earned per block for 6,500 blocks (180 / 6,500).

- The total amount of LOOKS staked from ALL users is 1,000,000 LOOKS.

- This means that User A will be allocated:

0.027692 * (10,000 / 1,000,000) = 0.00027692 WETHat block #6501.

- The amount of passive tokens staked is 10% of the total amount of tokens staked, meaning 20 WETH

- At block #6502,

- Assuming User A's stake does not change, but the total amount of LOOKS staked from all users increases to 1,500,000 LOOKS, then User A will be allocated:

0.027692 * (10,000 / 1,500,000) = 0.00018641 WETHat block #6502.

- Assuming User A's stake does not change, but the total amount of LOOKS staked from all users increases to 1,500,000 LOOKS, then User A will be allocated:

- This calculation each block will then continue for another 6,498 blocks (since our example covers a 6,500 block period), with 0.027692 WETH as the amount to be earned per block.

- The WETH fees generated from trades on the LooksRare platform in the 6,500-block period between block #6501 and block #13000 will then be used as the rewards to be distributed linearly over the next period, which will be from block #13001 and #19500.

You might be wondering about LooksRare's economic model at this point after reading about its tokenomics and how it supports the platform. The arithmetic behind each reward is straightforward, as we just mentioned. They follow a similar pattern: rewards = (# of User's XXX / # of Total XXX) * Periodical XXX Bonus. Such simplicity has both pros and cons. On the one hand, it's easy to come up with and put into practice. Users may easily grasp it and begin experimenting with the platform and tokens. Unlike the DeFi project, the NFT marketplace should be simple for users to use because they might not be interested in complex mathematical calculations like those used in DeFi.

On the other hand, speculators can more readily see the flaws in a straightforward rewarding mechanism. Wash trading is one of the example that shows the economic model is susceptible to such "attack".

To effectively describe the economic model, I created a circular flow chart:

The initial airdrop attracted valuable users from OpenSea to list NFT on LooksRare --> Token in circulation increases, and there are NFTs coming to the platform. Trading rewards boost the trading volume --> Platform collects platform fees in WETH as staking rewards to give back to stakers --> Staking rewards APR increases (up to 1,000% not long after initial launch) so that users tend to stake their LOOKS token --> Token in circulation decreases. The token price increases as the platform gets more popular and the token in circulation gets smaller --> More people use the platform and contribute to trading volume, the circulation continues. Wash trading could happen since the value of LOOKS tokens earned was high enough to cover the cost of the platform fee in WETH.

However, the model can also be suffering from a "Token value death spiral" because of external factors like crypto/NFT bear market. When it's a bear market, trading volume decreases drastically --> staking rewards APR decreases and token in circulation increases --> token value decreases, so many users will leave --> trading volume keeps decreasing and the "death spiral" begins.

As these two circular flow charts suggest, LooksRare is strongly binded to the LOOKS token. At the time of writing, the LOOKS token price is $0.2647. If the team wants to enter the "healthy circulation" again in the next bull market, they have to improve the platform and refine the rewarding model to attract and retain users.

That's it for the business side of LooksRare. Let's now have a glance at the technical side.

This page contains a list of all the deployed contract addresses. Due to a lack of space, I just chose a few of the interesting ones to discuss. To analyze the LooksRare's technical architecture, I might write another report.

Let's first look at the core of LooksRare exchange. It execute NFT trade after the buyer and the seller have agreed on a price.

/**

* @notice Constructor

* @param _currencyManager currency manager address

* @param _executionManager execution manager address

* @param _royaltyFeeManager royalty fee manager address

* @param _WETH wrapped ether address (for other chains, use wrapped native asset)

* @param _protocolFeeRecipient protocol fee recipient

*/

constructor(

address _currencyManager,

address _executionManager,

address _royaltyFeeManager,

address _WETH,

address _protocolFeeRecipient

) {

// Calculate the domain separator

DOMAIN_SEPARATOR = keccak256(

abi.encode(

0x8b73c3c69bb8fe3d512ecc4cf759cc79239f7b179b0ffacaa9a75d522b39400f, // keccak256("EIP712Domain(string name,string version,uint256 chainId,address verifyingContract)")

In the constructor, we instantiate the value of important variables like the addresses of smart contracts we are interacting with and the fee recipients.

/**

* @notice Cancel all pending orders for a sender

* @param minNonce minimum user nonce

*/

function cancelAllOrdersForSender(uint256 minNonce) external {

require(minNonce > userMinOrderNonce[msg.sender], "Cancel: Order nonce lower than current");

require(minNonce < userMinOrderNonce[msg.sender] + 500000, "Cancel: Cannot cancel more orders");

userMinOrderNonce[msg.sender] = minNonce;

emit CancelAllOrders(msg.sender, minNonce);

}

/**

* @notice Cancel maker orders

* @param orderNonces array of order nonces

*/

function cancelMultipleMakerOrders(uint256[] calldata orderNonces) external {

require(orderNonces.length > 0, "Cancel: Cannot be empty");

for (uint256 i = 0; i < orderNonces.length; i++) {

require(orderNonces[i] >= userMinOrderNonce[msg.sender], "Cancel: Order nonce lower than current");

_isUserOrderNonceExecutedOrCancelled[msg.sender][orderNonces[i]] = true;

}

emit CancelMultipleOrders(msg.sender, orderNonces);

}

These two functions are for cancelling orders. LooksRare like OpenSea uses a system of hybrid orders (off-chain/on-chain) which incorporates off-chain signatures (these are called Maker Orders) and on-chain orders (called Taker Orders). LooksRare uses exclusively EIP-712 signatures, which provide key benefits for users such as greater readability for humans in the message they sign. A maker order is a passive order, which can be executed (if not cancelled!) against a taker order after it is signed. Since the execution of a maker order is done once a taker order matches on-chain, network gas fees are never paid by the maker user.

There are three functions to match maker orders with taker orders and let's look at the first one.

This function matches a maker sell order against a taker buy order if the currecny is ether or wrapped ether:

First we do some sanity checks:

/**

* @notice Match ask with a taker bid order using ETH

* @param takerBid taker bid order

* @param makerAsk maker ask order

*/

function matchAskWithTakerBidUsingETHAndWETH(

OrderTypes.TakerOrder calldata takerBid,

OrderTypes.MakerOrder calldata makerAsk

) external payable override nonReentrant {

require((makerAsk.isOrderAsk) && (!takerBid.isOrderAsk), "Order: Wrong sides");

require(makerAsk.currency == WETH, "Order: Currency must be WETH");

require(msg.sender == takerBid.taker, "Order: Taker must be the sender");

// If not enough ETH to cover the price, use WETH

if (takerBid.price > msg.value) {

IERC20(WETH).safeTransferFrom(msg.sender, address(this), (takerBid.price - msg.value));

} else {

require(takerBid.price == msg.value, "Order: Msg.value too high");

}

Then we transfer the payment amount to this smart contract in ether or wrapped ether

// If not enough ETH to cover the price, use WETH

if (takerBid.price > msg.value) {

IERC20(WETH).safeTransferFrom(msg.sender, address(this), (takerBid.price - msg.value));

} else {

require(takerBid.price == msg.value, "Order: Msg.value too high");

}

// Wrap ETH sent to this contract

IWETH(WETH).deposit{value: msg.value}();

// Check the maker ask order

bytes32 askHash = makerAsk.hash();

_validateOrder(makerAsk, askHash);

Then we check the signature of the sell order. There is no need to check the signature of the buy order since only the buyer can send the buy order.

// Check the maker ask order

bytes32 askHash = makerAsk.hash();

_validateOrder(makerAsk, askHash);

// Retrieve execution parameters

(bool isExecutionValid, uint256 tokenId, uint256 amount) = IExecutionStrategy(makerAsk.strategy)

.canExecuteTakerBid(takerBid, makerAsk);

Then we check if the payment amount is enough:

// Retrieve execution parameters

(bool isExecutionValid, uint256 tokenId, uint256 amount) = IExecutionStrategy(makerAsk.strategy)

.canExecuteTakerBid(takerBid, makerAsk);

require(isExecutionValid, "Strategy: Execution invalid");

// Update maker ask order status to true (prevents replay)

_isUserOrderNonceExecutedOrCancelled[makerAsk.signer][makerAsk.nonce] = true;

Then we save the nonce of the order in the mapping to prevent replay attack of the order.

// Update maker ask order status to true (prevents replay)

_isUserOrderNonceExecutedOrCancelled[makerAsk.signer][makerAsk.nonce] = true;

Then we transfer the payment to the seller, royalties to the NFT creator, and the platform fees to the LooksRare.

// Update maker ask order status to true (prevents replay)

_isUserOrderNonceExecutedOrCancelled[makerAsk.signer][makerAsk.nonce] = true;

// Execution part 1/2

_transferFeesAndFundsWithWETH(

makerAsk.strategy,

makerAsk.collection,

tokenId,

makerAsk.signer,

takerBid.price,

makerAsk.minPercentageToAsk

);

Finally, we transfer the NFT to the buyer and emit TakerBid event

// Execution part 2/2

_transferNonFungibleToken(makerAsk.collection, makerAsk.signer, takerBid.taker, tokenId, amount);

emit TakerBid(

askHash,

makerAsk.nonce,

takerBid.taker,

makerAsk.signer,

makerAsk.strategy,

makerAsk.currency,

makerAsk.collection,

tokenId,

amount,

takerBid.price

);

The other two functions are similar so I'll leave them for you to explore.

Competitor Review

LooksRare has been discussed extensively, and we now have sufficient information to evaluate its competitors.

- OpenSea

- Overview: The largest NFT market in the world, according to OpenSea, there are about 700 projects total, including naming systems like ENS (Ethereum Name Service), collecting games, trading card games, and collectible games. OpenSea was founded in 2017 and currently supports many blockchains, with Ethereum being the largest. It has over 200 workers, 600k users, 80 million NFTs, and $20 billion in trading activity.

- In 2021, nearly 90% of NFT trading volume happened on OpenSea.

- Since it dominates the NFT industry, competing marketplaces have a difficult time attracting people away from it in the first place. New users will tend to use the marketplace that is currently dominating the market.

- Platform Fee: 2.5%

- Offering three different options for listing:

- Fixed Price Listings: Fixed price set by the seller

- English Auctions: The seller sets the minimum price, waits for bids to climb up, and accepts the highest. Here, the seller can set a minimum reserve price for the NFT.

- Dutch Auction: Sellers set starting price, an end price and duration. You start the auction at a high price and let the price decline over time. People will then buy the NFT at the price they see fit.

- Backed by Venture Capital and does not give back to the community (Web3 principles).

- Does NOT support batch buy/sweep floors

- gem.xyz

- Overview: An NFT marketplace aggregator that gathers all NFT transaction information from different chains and consolidates it in one place - improves the efficiency and effectiveness of the transaction.

- Features:

- Buy multiple NFTs in a single transaction

- Sweep the collection floor

- Pay with any token (or multiple ones)

- save tons gas compared to buying on the marketplaces directly

- X2Y2

- Similar UI to OpenSea, Similar economic model, marketing strategy, and docs to LooksRare

- The math of rewards is more complex than LooksRare's

- Does support batch buy/sweep floors

It's worth mentioning that LooksRare has been integrated with geniexyz to allow users to sweep the floor like they can do it using gem.xyz or X2Y2. Long-term competition between LooksRare and X2Y2 and OpenSea is increased by these actively integrated new features (LooksRare's Collection offer, Trait offer, and Multi-cancellation).

Closing Thoughts

By putting the community first, new NFT markets like LooksRare compete with industry leader OpenSea in a Web3 approach. Through "Vampire Attack," LooksRare and X2Y2 have effectively attracted people and attention from OpenSea, but retaining those users is currently the most essential issue. Although the prices of LOOKS ($0.26) and X2Y2 ($0.13) at the time of writing are less than most users had expected, we can see that the teams and community are still actively improving the platforms. The token prices demonstrate how significantly the current NFT bear market has impacted various NFT marketplaces. However, given the trading volume on OpenSea is equally subpar, we cannot yet declare the demise of LooksRare, X2Y2, and other marketplaces. If OpenSea has its own cryptocurrency, I think the price will also drop significantly. OpenSea was formed in 2017, however it didn't achieve success until the 2021 NFT bull market. The supremacy of OpenSea will be challenged by innovative platform(s) in the upcoming bull market.

Disclaimer: The information provided on this website is provided solely for educational purposes and does not constitute any advice, including but not limited to, investment advice, trading advice or financial advice, and you should not treat any of the website's content as such. Social Media Examiner recommends that you independently research any information contained on this Website and that you speak with an investment professional before making any decision to purchase, trade, hold or sell cryptocurrency. Nothing herein should be treated as a recommendation to buy, sell or hold cryptocurrency. Social Media Examiner cannot guarantee the accuracy of any information listed on the website and is not responsible for any missing or wrong information. All information is provided as is and should be used at your own risk. Social Media Examiner disclaims all responsibility and liability for your use of any information found on the website.

References

Mapping the NFT revolution: market trends, trade networks, and visual features, https://www.nature.com/articles/s41598-021-00053-8

LooksRare — Upcoming competitor of Opensea, https://blog.cryptostars.is/looksrare-decentralised-nft-marketplace-58adbce39d07

LooksRare NFT marketplace after a month - the past, present and the way ahead? (NFTmemo #1), https://mirror.xyz/mattbullish.eth/HiN9mtzqex0OVoURXCQZU6yLxmPal6md5qVnAk2K5v0

NonFungible, Quarterly NFT Market Report Q2 2022, https://nonfungible.com/reports/2022/en/q2-quarterly-nft-market-report

A Comprehensive Analysis of 5 Popular NFT Marketplaces, https://onxrp.com/analysis-of-nft-marketplaces/